DONATE CRYPTO

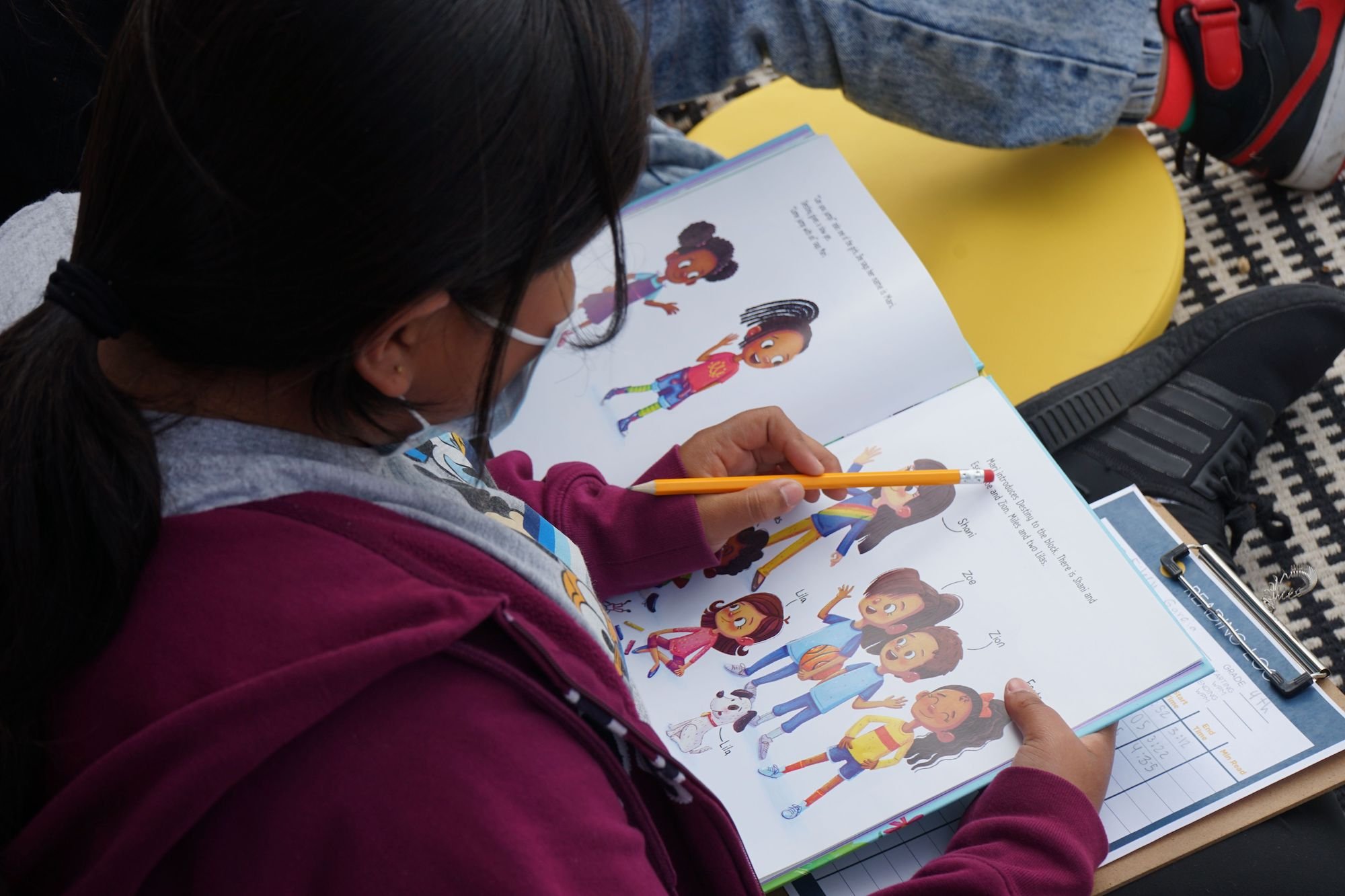

Your cryptocurrency donation will help provide children and families access to mobile after-school programs and human services. Our fleet of trucks deliver: food relief, social emotional skills training and literacy programs.

The Giving Block

Tax Benefits:

Donating cryptocurrency is a great way to support Mobilize Love as you won’t owe capital gains tax on the appreciated amount & can deduct it on your taxes.

The IRS classifies cryptocurrencies as property, so cryptocurrency donations to 501(c)(3) charities receive the same tax treatment as stocks. Donating cryptocurrency is a non-taxable event, meaning you do not owe capital gains tax on the appreciated amount and can deduct it on your taxes. Please contact your tax or financial advisor for more information.

For more information, please check out our FAQ’s below.

FAQs

-

We accept the following cryptocurrencies: Bitcoin (BTC) Ethereum (ETH) Basic Attention Token (BAT) Aave (AAVE) Alchemix (ALCX) Amp (AMP) Ankr Network (ANKR) Axie Infinity Shards (AXS) Balancer (BAL) Bancor Network Token (BNT) BarnBridge (BOND) Bitcoin Cash (BCH) ChainLink (LINK) Compound (COMP) Curve (CRV) Dai (DAI) Decentraland (MANA) Dogecoin (DOGE) Enjin Coin (ENJ) Fantom (FTM) Filecoin (FIL) Gemini Dollar (GUSD) Injective Protocol (INJ) Kyber Network (KNC) Litecoin (LTC) Livepeer (LPT) Loopring (LRC) Maker (MKR) Mirror Protocol (MIR) Moss Carbon Credit (MCO2) Orchid (OXT) PAX Gold (PAXG) Polygon (MATIC) Ren (REN) Skale (SKL) Somnium Space (CUBE) Storj (STORJ) SushiSwap (SUSHI) Synthetix (SNX) Tezos (XTZ) The Graph (GRT) The Sandbox (SAND) Smooth Love Potion (SLP) Terra (LUNA) TerraUSD (UST) UMA (UMA) Uniswap (UNI) Yearn.Finance (YFI) Zcash (ZEC) 0x (ZRX) 1inch (1INCH)

-

You can access all of our wallet addresses by using the widget above. Once you enter the type of cryptocurrency and reach the third step, you will receive a unique wallet address which can then be used to complete your donation.

-

Once you’ve filled out your information and receive a unique wallet address, this address can be used an infinite amount of times without having to re-enter any information on our page.

-

In order to receive a receipt with your donation, you must enter your email when prompted to in our widget above.

-

Yes, of course! However, we cannot provide tax receipts to anonymous donors. Tax receipts and gift acknowledgements can only be received once you’ve entered your email address.

-

If you want to learn more about how donating crypto can lower your taxes, check out thegivingblock.com/faq. Talk to a crypto-savvy tax professional or connect with The Giving Block to get connected with one. If you have any questions about Mobilize Love or your donation, please reach out to info@mobilizelove.org for more information.

The IRS classifies cryptocurrencies as property, so cryptocurrency donations to 501(c)3 charities receive the same tax treatment as stocks. Donating cryptocurrency is a non-taxable event, meaning you do not owe capital gains tax on the appreciated amount and can deduct it on your taxes. Please contact your tax or financial advisor for more information

-

The Giving Block supports the ERC-20 Polygon (MATIC) asset but The Giving Block does not support transfers via the Polygon/Matic network. In order to successfully donate Polygon (MATIC) to a charity please be sure the assets you are transferring are on the Ethereum mainnet (ERC-20 token).